- Contents

3. Status in employment

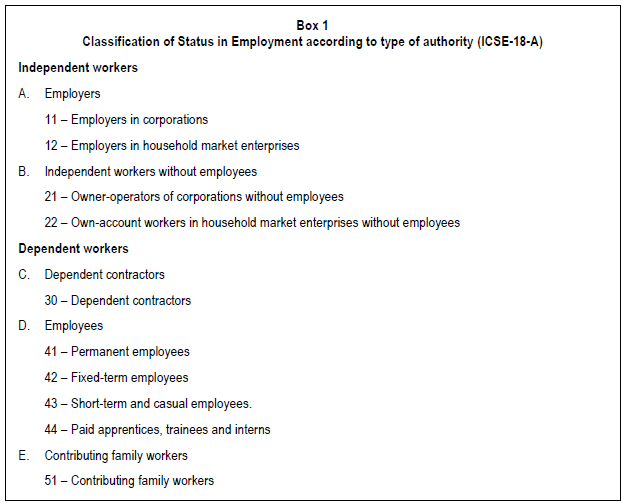

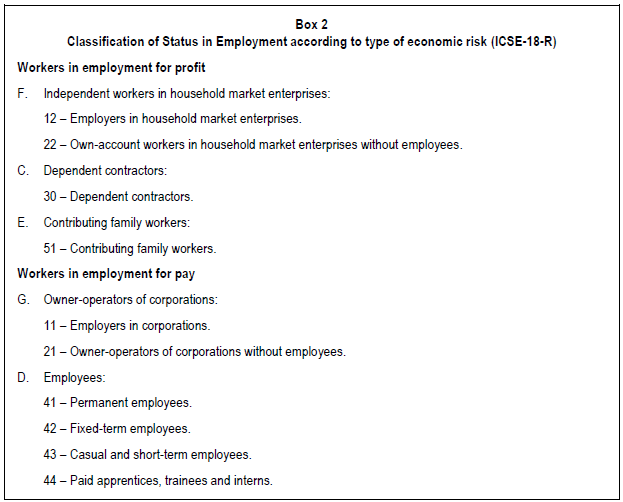

86. The proposal for a revised ICSE-18 classifies jobs in employment for pay or profit based on the type of authority the worker is able to exercise in the job and the type of economic risk to which the worker is exposed. The ten detailed categories in ICSE-18 have the same definitions, scope and codes as the equivalent categories in the Classification of Status at Work. These categories are used as common building blocks to create two alternative classification hierarchies, one according to the type of authority the worker is able to exercise in relation to the work performed and the other according to the type of economic risk to which the worker is exposed.

87. The draft resolution notes that the two hierarchies for status in employment based on economic risk and on authority should have equal priority in the compilation of statistical outputs. Statistics from Labour Force Surveys and other relevant sources should be compiled on a regular basis according to both hierarchies. The hierarchy used will depend on the analytical purpose of the output in question.

88. The hierarchy based on the type of authority can be used to produce statistics on two broad groups of workers in employment: independent workers and dependent workers. This hierarchy is referred to as the ICSE-18 according to type of authority and abbreviated to ICSE-18-A. It is suitable for various types of labour market analysis, including analysis of the impact of economic cycles on the labour market, analysis of government policies related to employment creation and regulation, and as a starting point for the identification of entrepreneurs.

89. The second hierarchy, based on the type of economic risk, produces the dichotomy between workers in employment for profit and workers in employment for pay. This is analogous to the traditional distinction between self-employment and paid employment. This hierarchy is referred to as the ICSE-18 according to type of economic risk, and abbreviated to ICSE-18-R. It is suitable for the provision of data for national accounts, for the identification of wage employment and its distribution, and for the production and analysis of statistics on wages, earnings and labour costs.

90. The detailed categories in the ICSE-18 classification structures are assigned the same twodigit numerical code in each classification, the first digit being the same as the code for the aggregate categories in ICSaW-18. The aggregate categories in the two ICSE-18 hierarchies are assigned a single-character unique alphabetic code, so as to avoid confusion with the equivalent categories in ICSaW-18 that have a broader scope than in ICSE-18.

Summary of differences between ICSE-93 and the proposed ICSE-18

91. Since the ICSE-18 is comprised of categories that relate to employment as defined by the 19th ICLS resolution I, it is narrower in scope than ICSE-93. Specifically, the 19th ICLS concept of employment excludes own-use production of goods, all categories of volunteer work, unpaid trainee work and compulsory unpaid work. Since the scope of ICSE-93 is based on the 13th ICLS concept of employment, it includes own-use production of goods, certain categories of volunteer work, unpaid trainee work and some types of compulsory unpaid work.

92. The ICSE-93 has a single hierarchical structure comprising five substantive categories that are aggregated according to a combination of the type of economic risk and the type of authority to form the dichotomous categories of “paid employment jobs” and “selfemployment jobs”. The ICSE-18 has ten detailed categories that may be aggregated either according to type of economic risk or type of authority to form two alternative hierarchies.

93. The additional detailed groups in ICSE-18 relate to some of the concepts defined in paragraph 14 of the 15th ICLS resolution concerning the International Classification of Status in Employment (ICSE-93) which outlines the “possible statistical treatment of particular groups of workers”. These include the new categories in ICSE-18 which allow for the separate identification of owner-managers of corporations, dependent contractors and subcategories of employee. Some other “particular groups”, or the statistical needs underlying them, are reflected in the various cross-cutting variables included in the proposed standards.

94. The ICSE-18 group “owner-operators of corporations” is equivalent to the group “ownermanagers of incorporated enterprises” defined in ICSE-93 as a “particular group” which countries may need or be able to distinguish for specific descriptive or analytical purposes. The ICSE-93 notes that different users of labour market, social and economic statistics may have different views on whether these workers are best classified as in paid employment or as in self-employment. The ICSE-18 classifies them as independent workers in the classification by type of authority and as workers in employment for pay in the classification according to type of economic risk. The ICSE-18 also provides further disaggregation of owner-operators of corporations through separate detailed groups for those with employees and those without employees. Separate identification of these workers is important for statistics on employment by institutional sector, wages and income, labour market characteristics and workplace relations, as well as for input to the national accounts.

95. The new category for dependent contractors allows the identification of workers who are employed for profit but do not have full control over the activities of the economic unit for which they work. This category replaces the concept of “contractors” specified as a “particular group” in the ICSE-93 resolution. Paragraph 14 of this resolution defines contractors as workers who:

- (a) have registered with the tax authorities (and/or other relevant bodies) as a separate business unit responsible for the relevant forms of taxes, and/or who have made arrangements so that their employing organization is not responsible for relevant social security payments, and/or the contractual relationship is not subject to national labour legislation applicable to, for example, “regular employees” but who;

- (b) hold explicit or implicit contracts which correspond to those of “paid employment”.

96. The ICSE-93 resolution notes that these workers may be classified as in a “selfemployment job”, or as in a “paid employment job” depending on national circumstances. In ICSE-18, dependent contractors are classified as “dependent workers” in the classification according to type of authority and as “workers in employment for profit” in the classification according to type of economic risk. The ICSE-18 concept of dependent contractors is also somewhat broader than the ICSE-93 concept of contractors, in the sense that there is no requirement for registration as a separate business, for exemption from employer responsibilities for social security payments, or to make arrangements such that the contractual relationship is not subject to national labour law. Nor is there any requirement for contracts which “correspond to those of paid employment”.

97. In some cases, the statistical treatment of the “particular groups” defined in paragraph 14 of the 15th ICLS resolution is clarified by the draft 20th ICLS resolution, even though these categories are not separately identified or replaced by the new proposed standards. For example, franchisees who engage employees or who operate incorporated enterprises, will be classified as independent workers. If they have no employees however, and their business is not incorporated, they may be classified as dependent contractors. Sharecroppers, as defined in ICSE-93, would generally be classified as dependent contractors if they have no employees. Work gang (crew) members are covered by an inclusion statement in the ICSE-18 definition of employees.

98. Subcategories are provided for employees in order to provide more detailed information about the stability of employment relationships for these workers, to allow the identification of employees with non-standard employment arrangements, and to allow the identification of paid apprentices, trainees and interns.

99. In addition to the provision of more detailed groups, ICSE-18 also makes adjustments to the boundaries between certain categories. In ICSE-93, the distinction between employers and own-account worker is based on whether or not employees were engaged on a continuous or regular basis. In the draft 20th ICLS resolution this is clarified by removing the word “continuous” and noting that “on a regular basis” should be interpreted as having at least one employee during the reference period and at least two of the three weeks immediately preceding the reference period.

100. The category of contributing family workers has been extended in ICSE-18 to include workers who help family members in a job in which the assisted family or household member is an employee or dependent contractor, in addition to those who assist in an enterprise operated by a family member.

Employment in cooperatives

101. The ICSE-93 category Members of producers’ cooperatives is not used by most countries, and is not identified as a separate category in the proposed new standards. The number of persons employed in this category is very small in almost all countries. This gives a misleading impression of the impact of cooperatives on employment, however, as employment in other types of cooperatives and of persons who are not members of the cooperative is not covered. In addition, since members of producer cooperatives are generally enterprises, rather than persons, the workers who own and operate these enterprises may frequently be classified in ICSE-93 as own-account workers or employers in their own enterprises, rather than as workers in the cooperative. In ICSE-18 they are classified as independent workers.

102. Members of worker cooperatives (worker members), on the other hand, are individuals who work in a cooperative which they jointly own. Like employee shareholders in other types of corporations, they have a vote on key decisions and on election of the board. Voting is based on membership (one member one vote) rather than on the share of capital, however. Since they do not have the same degree of control over the business as a majority shareholder they are classified in ICSE-18 as dependent workers. Classifying worker members of cooperatives as independent workers would also mean many of them might be classified as employers, since some worker cooperatives have employees who are not members. This could potentially result in misleading statistics on the number of employers.

103. If worker members of cooperatives are paid for time worked or for each task or piece of work done in the cooperative, they should be classified as employees of their own cooperative; if they are paid only in profit or surplus, or paid a fee per service, they should be classified as dependent contractors.

104. Further guidance on the treatment of employment in cooperatives is provided in the draft Guidelines for statistics of cooperatives to be presented for consideration and possible endorsement at the 20th ICLS.

Definitions and explanatory notes for categories in the two hierarchies of the International Classification of Status in Employment

105. Short definitions of each category included in ICSE-18 are provided in the draft resolution. The aim is to provide clarity on the conceptual boundaries between the categories and sufficient detail to support the development of operational methods for measurement, without however going into lengthy discussion on methods for measurement. To avoid repetition, the definitions of the detailed categories do not include information that is covered in the definitions of the relevant higher level categories. As a result, the detailed definitions cannot stand alone without making reference to the higher level category.

106. More detailed information on measurement and comprehensive stand-alone explanatory notes for each category will be included in the papers on guidelines for data collection and the conceptual framework for statistics on work relationships, to be presented as room documents during the 20th ICLS.

107. While all the categories are defined in the draft resolution, some additional information is necessary to properly understand the context of the definition and is provided below.

Independent workers

108. In ICSE-18-A, independent workers are disaggregated first according to whether or not they had one or more employees on a regular basis. Employers and independent workers without employees are then further disaggregated according to whether or not the economic unit they own and control is a corporation or a household market enterprise.

Employers

109. In ICSE-93, the distinction between employers and other independent workers is based on whether or not employees were engaged on a continuous or regular basis. This was not considered to be sufficiently precise for measurement on a consistent basis, did not necessarily reflect short-term changes in labour market conditions, and was not aligned with the reference period used for other labour market statistics. In the draft 20th ICLS resolution the definition of employer is clarified by a statement that “on a regular basis” should be interpreted as having at least one employee during the reference period and at least two of the three weeks immediately preceding the reference period.

110. There is not complete agreement on the definition of employers, however. Some labour statisticians would prefer to base the definition on the same short reference period that is used to determine Labour Force Status. This means that any worker who employed at least one person during the reference period as an employee, would be classified as an employer. It can be argued, however, that the socio-economic characteristics of those who only engage employees occasionally are more similar to those of independent workers without employees than to those who have employees on a regular basis. Since it is common for businesses in some countries to hire employees on a casual basis for just one day, there are concerns that changing the definition to a short reference period without further qualification could lead to a significant increase in the number of employers and more volatility in the statistics, especially for employers and own-account workers in agriculture.

111. If the definition of employer were based only on the reference period, the draft resolution may need to state that, if relevant in the national context, countries should separately identify employers who have employees on a regular basis from those who have employees only on an occasional basis along the following lines:

- Employers own the economic unit in which they work and control its activities on their own account or in partnership with others, and in this capacity employ one or more persons (including temporarily absent employees but excluding themselves, their partners and family helpers) to work as an employee during the reference period.

- Employers include those who have employees on a regular basis and those who have employees only on an occasional basis. Employers who have employees on a regular basis are those who usually have at least one employee during the reference period and at least two of the three weeks immediately preceding the reference period. Statistics on employers may be compiled either for those who have employees on a regular basis, or for all employers. When statistics are collected for all employers, those employers who have employees on a regular basis should, where possible, be identified separately from those who have them only on an occasional basis.

Owner-operators of corporations

112. The draft resolution defines owner-operators of corporations as workers who hold a job in an incorporated enterprise in which they hold controlling ownership and have the authority to act on behalf of the enterprise. The term “incorporated enterprise” refers to enterprises that are constituted as separate legal entities from their owners.

113. The draft resolution provides examples of terms that are used to describe different types of incorporated enterprise (limited liability corporation, limited partnership). To identify owner-operators of corporations in surveys, however, it will be necessary to ask questions of those who say they operate a business using terms for the specific legal forms that exist in the country. While respondents who do not operate an incorporated enterprise may not be familiar with these terms, it is likely that those who do operate such businesses, as well as their proxy respondents, will be well aware of the legal form of their business.

114. In ICSE-18-R, owner-operators of corporations are further disaggregated according to whether or not the enterprise has one or more employees on a regular basis.

Dependent contractors

115. The need for information on the group of workers frequently referred to as the “dependent self-employed” has been a major challenge for many statistical agencies in both the developed and developing world. These are workers who have contractual arrangements of a commercial nature to provide goods or services for or on behalf of another economic unit, are not employees of that economic unit, but are dependent on that unit for organization and execution of the work or for access to the market. Since these jobs do not fit comfortably into any of the substantive categories in ICSE-93, they are frequently classified either as own-account workers or as employees, resulting in overestimation of one or the other of these groups (or of both). As a result, it is difficult to monitor structural change in this important form of employment, which is considered by many researchers to be growing. This also impacts on the monitoring of structural change among both employees and independent workers. The need to address this problem was among the most challenging but also most important objectives of the revision work.

116. The ILO report for discussion at the Meeting of Experts on Non-Standard Forms of Employment held in Geneva from 16 to 19 February 2015, described dependent selfemployment as a situation in which “workers perform services for a business under a civil or commercial contract but depend on one or a small number of clients for their income and receive direct instructions regarding how the work is to be done”. That Meeting of Experts noted that non-standard forms of employment included, among others, “disguised employment relationships” and “dependent self-employment”. The first of these refers to workers who provide their labour to others while having contractual arrangements that correspond to self-employment. The second refers to those who operate a business without employees but do not have full control or authority over their work.

117. Statistics are needed about both groups to inform policy concerns about the use of contractors, transfer of economic risk from employers to workers, access to social protection and trends in non-standard forms of employment. There is a need for objective information to assess the extent to which jobs in these categories provide flexibility for both workers and employers, provide opportunities for labour market participation, and to inform debate on labour market policies and regulation. While ideally the two groups should be separately identified rather than grouped together, this is difficult to achieve operationally. The concept of dependent contractors proposed in the draft resolution covers both of these groups and allows for the separate identification of the two subgroups if feasible and relevant in the national context.

118. The need to include a category for this group in the classifications according to status has been widely (although not universally) accepted by labour statisticians and was strongly supported during the regional consultations. It is recognized in many countries to be a statistically significant and growing group, although comprehensive statistics about them are rarely available. Since they are both dependent workers and employed for profit they are identified as a separate group at the second level of each hierarchy in ICSE-18. This is necessary to ensure their statistical visibility. Moreover, it would be inappropriate to represent them as a subset of employees in one classification hierarchy and as a subset of independent or own-account workers in the other.

119. The types of job that should be included are quite diverse in terms of the nature of the work performed and the nature of the worker’s dependence on another economic unit. In many cases they involve types of contractual arrangement that have been in existence and inconsistently classified for many years. Examples include hairdressers who rent a chair in a salon and whose access to clients is entirely dependent on the salon owner, waiters who are paid only through tips from clients, vehicle drivers who have a service contract with a transport company which organizes their work, home-based workers who are contracted to perform manufacturing tasks such as assembling garments, and consultants working for corporations or government agencies.

120. The group also includes the emerging group of workers in the so-called “gig-economy” who have been the subject of considerable recent attention in academic, political and media discourse. Examples include vehicle drivers providing rides or parcel delivery services and home-based workers performing information-processing services, where organization of the work or access to clients is typically mediated through an Internet application controlled by a third party.

121. Despite this diversity, what workers in this group have in common is that they do not control the economic unit for which the work is performed, while being exposed to the economic risk associated with employment for profit. The different criteria used to define and measure them need to allow identification of those cases which fall into this category and are of genuine policy interest, while avoiding the identification of workers that are genuinely employees, freelance contractors or running their own business. These criteria also need to take account of the diversity of the nature of their dependency. Different criteria may therefore be more or less relevant, depending on the context.

122. Much of the early statistical development work on the definition and measurement of dependent contractors focused on dependence on one or a small number of clients. This approach, however, potentially includes genuinely independent workers who may have only a small number of clients in a given period, while excluding workers who have multiple clients but whose access to the market or access to raw materials is controlled by another entity. The working group for the revision of the ICSE-93 proposed additional features which could be used to identify dependent contractors such as payment of social contributions, type of payment received, dependence on another entity for access to the market, control over the price of the goods produced or services provided and various forms of control over the work performed.

123. The relevant section of the draft resolution starts with a short introductory sentence explaining the concept of dependent contractors that should ideally be measured. It then provides a short definition of a more operational nature: “workers employed for profit, who are dependent on another entity that exercises explicit or implicit control over their productive activities and directly benefits from the work performed by them”. To clarify the scope of the category, it goes on to note that dependency may be of an operational or economic nature and that the worker may be dependent on units in all sectors of the economy. A list of characteristics that may be relevant for the identification of dependent contractors, provides further clarification on the scope of the group and may also assist in the development of operational criteria for measurement.

124. Exclusion statements are provided to ensure that workers who have a contract of employment or are paid for time worked are classified as employees, not as dependent contractors. Similarly, workers who operate an incorporated enterprise, or who employ others to work for them as employees are classified as independent workers, even if their businesses are dependent on another enterprise. This establishes clear boundaries between the categories and ensures that classification is based on the relationship between the worker and the economic unit for which the work is performed, rather than on relationships between enterprises. The engagement of employees and incorporation of the enterprise both imply a degree of authority and control over the operation of an enterprise.

125. Testing currently under way in several countries is focusing strongly on the development of methods to identify dependent contractors in statistical collections, especially in household surveys. In order to differentiate these workers from own-account workers it is necessary to establish whether or not a single separate economic unit has control over access to the market or operational authority over the work. To differentiate them from employees, it is necessary to determine whether those who are reported in household surveys as working for someone else are in fact employed for profit.

126. The proposed measurement approach being tested identifies dependent contractors according to two streams from traditional status in employment questions: those who say they work for someone else, and those who say they are self-employed. It is possible to consider the workers identified by these two streams as if they were conceptually separate groups. Since this distinction is based on the perception of survey respondents, rather than on objective criteria, however, it does not provide a reliable distinction between the two groups of workers with disguised employment relationships and the dependent selfemployed. The draft resolution therefore proposes a single category of dependent contractors but notes that two subgroups of dependent contractors may be identified if information is available on the nature of the financial or material resources committed by the worker. More experience is required, however, before definitive guidance on measurement of dependent contractors can be provided.

Employees

127. The draft resolution defines employees as workers employed for pay, in a formal or informal business, who do not hold controlling ownership of the economic unit in which they are employed. The second part of this definition differentiates employees from owneroperators of corporations who may receive a wage or salary from the corporation that they own and operate. The four subcategories of employees allow permanent employees to be separately identified from fixed-term employees and from short-term and casual employees. Employment in this latter category may provide flexibility for workers who need to balance employment with family responsibilities, education, or other forms of work but may also entail insecurity of income and employment.

128. Permanent, fixed-term, short-term and casual employees are differentiated from each other based on three criteria:

- whether there is a specified date or event on which the employment will be terminated;

- the expected duration of the employment; and

- whether the employer agrees to provide work and pay for a specified number of hours in a set period and the worker agrees to work for at least the specified number of hours (contractual hours).

129. A boundary of three months is proposed to distinguish fixed-term from short-term employees. This reflects the thresholds of two or three months used in a number of countries to identify short-term employment for migrant workers. A duration of three months may also ensure the group is large enough to measure in typical household surveys.

130. The category of short-term and casual employees includes two very distinct groups: shortterm employees and casual or intermittent employees. In the case of short-term employees, the employment is by definition of a time-limited nature but provides a stable number of hours of work and income during that short period. Casual or intermittent employment may sometimes be of an ongoing nature, however, while providing no guarantee of employment for a certain number of hours. The resolution notes, therefore, that these two groups may be separately identified if relevant in national circumstances and provides a definition of each group.

131. A separate category is provided for paid apprentices, trainees and interns to allow separate identification of this group and to avoid including them among fixed-term or short-term employees. This will improve the comparability of statistics on fixed-term and short-term employees between countries with large numbers of paid apprentices, trainees and interns, and those where paid trainee work is less common. Exclusion statements establish clear boundaries between this group and workers undergoing periods of probation following the start of a job, workers undergoing in-service training while in employment, unpaid trainee workers and contributing family workers.

Contributing family workers

132. Contributing family workers continue to be a statistically important group in many countries of the world. In many industrialized countries, however, they represent only a small proportion of total employment. The proposed definition of this group seeks to clarify the boundary between these workers and employees by specifying that they do not receive regular payments, such as a wage or salary in return for the work performed. It notes, however, that they may benefit in kind or receive irregular payments as a result of the outputs of their work through family or intra-household transfers. The boundary between contributing family workers and own-account workers and employers is established by the statement that contributing family workers do not make the most important decisions affecting the enterprise or have responsibility for it.

133. Based on the results of testing for the implementation of the 19th ICLS standards, it is recommended that, at least for countries where these workers are an important group, an initial question based on self-identification should be followed by questions on whether a wage or salary is received and whether those initially identified as contributing family workers make decisions about the business. In this way it is possible to determine, for example, whether both husband and wife working in a family business should be classified as employers/own-account workers, or whether one of them should be classified as a contributing family worker.